In the previous year, AI-driven sales automation startup 11x appeared to be on a rapid growth path. However, according to nearly two dozen sources, including investors as well as current and former employees, the company has faced financial difficulties primarily due to internal factors.

Individuals in both the U.S. and the U.K. conveyed to TechCrunch that the circumstances have become so precarious that 11x’s lead Series B investor, Andreessen Horowitz, might be contemplating legal action. Nonetheless, a representative from Andreessen Horowitz denied such claims, asserting that the firm is not pursuing a lawsuit.

11x provides an AI bot designed for outbound cold sales tasks, including prospect identification, custom message creation, and the scheduling of sales calls. The company is part of a growing sector known as AI sales development representatives, or AI SDRs.

Founded in 2022 by Hasan Sukkar, 11x reportedly neared $10 million in annualized recurring revenue within two years of its launch. The company transitioned from London to Silicon Valley last July, announcing a $24 million Series A round led by Benchmark in September. TechCrunch later reported on a $50 million Series B round led by Andreessen Horowitz the same month. Benchmark did not offer any comments.

According to three current and former 11x employees, many of its early customers utilized “break clauses” in their sales contracts to stop using the product, citing issues such as non-functioning email services or hallucinations.

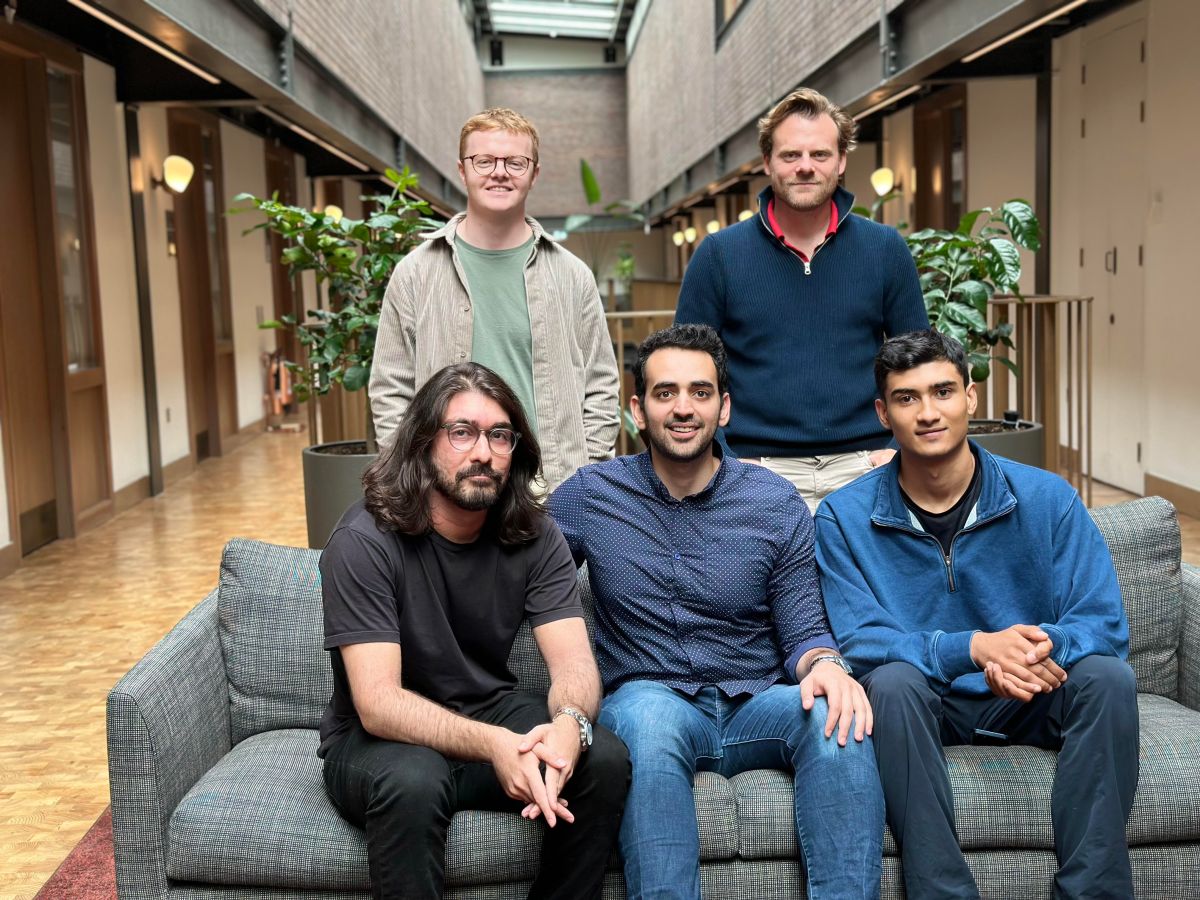

Internally, the company faced challenges as well. The work environment was described as arduous and stressful, even for those accustomed to hustle culture. Of the early employees featured in a launch photo by TechCrunch, only Sukkar, the CEO, remains.

A section of 11x’s website displayed company logos suggesting endorsements, a common practice among startups. However, TechCrunch discovered that multiple companies whose logos were displayed were not actual customers, with at least one considering legal action.

“We did not authorize the use of our logo, and we are not a customer,” a ZoomInfo spokesperson reported to TechCrunch. After TechCrunch inquired about this issue on March 6, the logo was removed, although the company’s phone AI agent continued to claim the endorsement after that date.

ZoomInfo, which provides sales data and automation tools, conducted a brief one-month trial of the AI SDR from mid-January through mid-February. According to a ZoomInfo spokesperson, the 11x product performed significantly worse than their own SDRs, leading them to discontinue use.

Since November, however, 11x claimed ZoomInfo as a customer across various platforms, the spokesperson insisted, causing ZoomInfo to repeatedly request the removal of their logo and to stop being falsely listed as a customer. ZoomInfo’s lawyer is now threatening legal action, citing potential legal grounds including deceptive trade practices and false advertising.

Moreover, Airtable’s logo featured on 11x’s website until recently. As of March 20, 11x’s website continued to list Airtable as a “customer” on their manifesto page. Airtable clarified they were neither a customer nor had given permission for their logo’s use. Their short trial of the product last year ultimately led them to decide against its fitting for their business.

Despite these instances, some customer claims were verified as legitimate, with companies like Pleo and Rho confirming their use of 11x products. 11x stated that they “promptly removed any undesired or inaccurate customer mentions on their site and within their products when requested,” attributing any lapse to “human error.”

At least three employees decided to leave the company due to perceived questionable practices. For instance, prospective customers were encouraged to sign one-year contracts for pilot programs, with a typical break clause at three months, effectively making it a trial period. When reporting annual recurring revenue (ARR), the company reportedly did not distinguish between trial periods and long-term contracts, presenting ARR based on the full year’s value.

11x explained that they use “contracted ARR (CARR)” when reporting, with investors being informed of this method and having reviewed customer contracts. Even when customers ended trials using the break clause, the company continued to count ARR as if these companies had completed a full-year contract, some employees suggested.

The startup argued that improvements in their product and refined sales towards their “ideal customer” resulted in a retention rate of 79%. However, concerns arose from criticisms over the product’s performance, including hallucinations, non-functionality, and billing issues.

The work environment under CEO Sukkar was reportedly grueling, with long expected hours and high pressure. Employees faced aggressive expectations and possible public reprimand in internal communications. A strong culture of fear over back pay led some employees to wait until after paydays to resign.

11x stated the employee turnover was partly due to their relocation from London to San Francisco, with their headcount doubling to 50 full-time employees in this period. Several employees reported awaiting back pay months after leaving.

Current employees shared that after recent payroll processing, they anticipated resignations over the ensuing days, emphasizing ongoing tensions about employee retention.